On Monday, the GBP/USD currency pair began a new round of correction within the framework of a new downward trend that had just begun. Last week, the quotes of the British currency, after several weeks of growth, finally settled below the moving average line. The meeting of the Bank of England and the Nonfarm report in the USA helped them in this. Recall that the Bank of England meeting could be interpreted as you like and expect any market reaction to this event. We assumed the market had achieved a 0.5% rate increase long before the official results were announced. Then after that, the pound should have started falling. However, everything could have been different, and what Andrew Bailey announced at the press conference is generally very difficult to interpret unambiguously.

Bailey noted that inflation in the UK would rise to 13%. By and large, what does this mean? Only that the Bank of England will continue or will have to raise the key rate, fully supporting the pace of tightening the Fed's monetary policy. So far, BA lags behind the Fed by 0.75%, but the more both banks raise the rate, the less expressive this gap becomes. In the end, the Fed will not be able to raise the rate forever. Sooner or later, it will stop.

Moreover, this may happen as early as the end of 2022 since forecasts for July inflation allow for the absence of a new acceleration in price growth. But in the UK, the head of the Central Bank openly declares that six consecutive rate hikes did not affect price growth. Well, maybe it just slowed them down a little. He said that the peak value of inflation this year could be about 13%. Do you remember how Bailey talked about 10% a few months ago, and even then, we questioned this figure? Now we are also questioning 13% because, as a rule, central banks try to be more optimistic than the situation allows them.

Things in the British economy may be much worse than Andrew Bailey sees.

In addition, Mr. Bailey openly announced the beginning of a recession in the British economy at the end of 2022 and called it the strongest since the global financial crisis. He also noted that inflation might take at least two years to return to the target level. Naturally, the market regarded all this information as pessimistic, but what if the Bank of England is still too optimistic in its judgments? If inflation rises to 13% (and while it is about 9%, that is, it will take at least a few more months for it to grow to 13%), then will only two years be enough to reduce it to 2%? We are talking about the fact that if inflation growth takes a year and a half, it may take at least 2-3 years to return it to digestible values.

Further, why, if BA has already raised the rate six times, does it continue to expect a strong acceleration in inflation? If things are as bad as the regulator predicts, then why can't inflation rise to 15%? And the recession may last not 15 months, as Andrew Bailey says now, but 20 or 25. The world's central banks have made a serious jump in prices, and their heads, who have repeatedly tried to calm the markets and the public, have been wrong enough in their forecasts. Therefore, things may be much worse than the chairman of the British regulator is telling us now. One thing is clear as day - the BA rate will continue to rise, although probably not at such a high rate as the Fed rate. And this would be a convincing reason for the British currency to show a new stage of growth against the US dollar if not for the high probability of a recession in the British economy with a low probability of the recession in the US. Thus, we believe that the pound and the euro can and should resume the formation of a long-term downward trend.

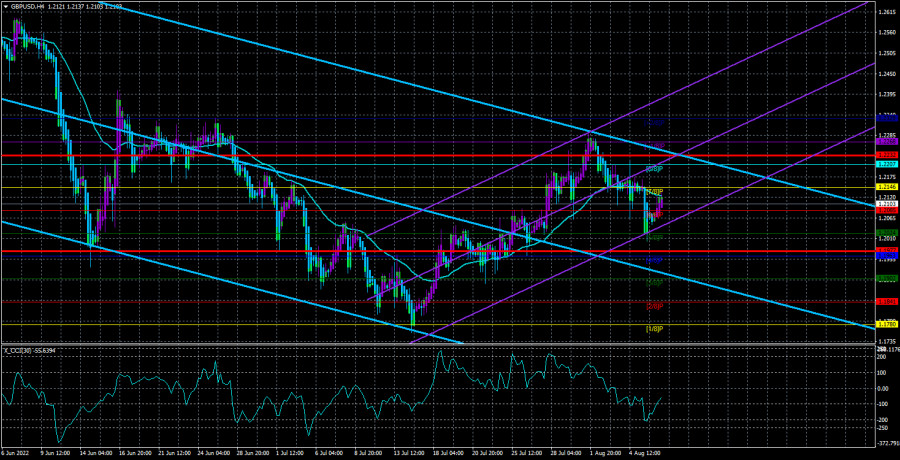

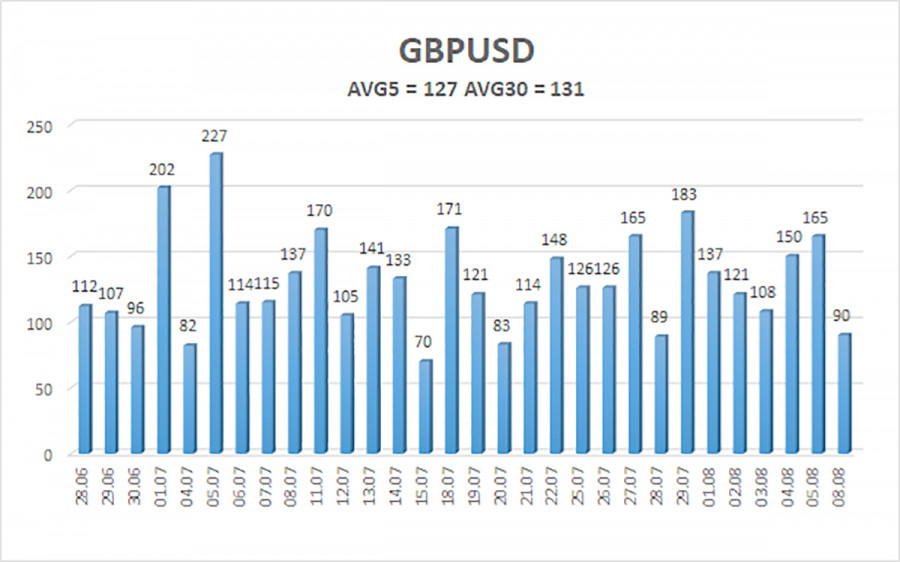

The average volatility of the GBP/USD pair over the last 5 trading days is 127 points. For the pound/dollar pair, this value is "high." On Tuesday, August 9, thus, we expect movement inside the channel, limited by the levels of 1.1977 and 1.2232. The reversal of the Heiken Ashi indicator downwards signals the resumption of the downward movement.

Nearest support levels:

S1 – 1.2085

S2 – 1.2024

S3 – 1.1963

Nearest resistance levels:

R1 – 1.2146

R2 – 1.2207

R3 – 1.2268

Trading Recommendations:

The GBP/USD pair continues to be located below the moving average on the 4-hour timeframe. Therefore, at the moment, new sell orders with targets of 1.2024 and 1.1977 should be considered in the event of a price rebound from the moving average. Buy orders should be opened when fixing above the moving average line with targets of 1.2207 and 1.2232.

Explanations of the illustrations:

Linear regression channels – help determine the current trend. The trend is strong if both are directed in the same direction.

Moving average line (settings 20.0, smoothed) – determines the short-term trend and the direction in which trading should be conducted now.

Murray levels are target levels for movements and corrections.

Volatility levels (red lines) are the likely price channel in which the pair will spend the next day, based on current volatility indicators.

The CCI indicator – its entry into the oversold area (below -250) or into the overbought area (above +250) means that a trend reversal in the opposite direction is approaching.