The attention of the market is still focused on the economic statistics published in the US and the result of the Fed's monetary policy meeting, which begins on Tuesday following last week's significant events.

It is worth noting that heated discussions about what should be expected from the US regulator in the near future continue in the investors' environment. Some are expecting that J. Powell will report after the Fed meeting on Wednesday regarding the possibility of starting to cut purchases of government bonds this year, probably in the fall. On the contrary, others believe that no signal will follow, despite the latest data on the strengthening of US inflationary pressures.

The presence of this dualism sways the markets, contributing to the growth of volatility. So, the yield of treasuries partially pulled back up after a sharp decline at the end of the previous week. The benchmark 10-year T-Note yield has fallen below the 1.5% mark and is still holding below it. All the behavior of the US government debt market indicates that investors in government bonds are not yet sure that the Fed is ready to signal a change in sentiment regarding the existing volumes of asset repurchases. It can be recalled that the regulator currently buys monthly treasuries in the amount of $ 60 billion.

It is necessary to realize one important thing: the US economy remains in a difficult situation despite the optimistic statements of officials. Any increase in yields will hit the country's ability to pay interest on government bonds. The growth of profitability will definitely cause a strong blow, which will be difficult for the authorities to fend off. The United States is not only in a difficult economic situation but also in a political one.

Faith in the dollar as the world's reserve currency helps America with its own economy, but if there is chaos in the bond market, it can lead to financial disaster. That is why the Fed cannot only change the monetary rate at the end of the Wednesday meeting but also give signals about a faster start to reduce the volume of redemption of treasuries.

Earlier, Powell and some members of the Central Bank stated that inflation growth is not yet critical for a change in the course of monetary policy. It is interesting what the FRS Chairman will say about this tomorrow, but we believe that he will try in every possible way to avoid a concrete answer to this topic and somehow mitigate the very tense situation.

In regards to today's events, the focus will be the publication of US retail sales data. Their volume is expected to fall by 0.7% in May. At the same time, the core retail sales index is expected to slightly rise by 0.2% in May against a 0.8% decline in April. The volume of industrial production will be presented as well, with a forecasted growth of 0.6% in May against 0.5% in April.

We believe that if the statistics do not turn out to be worse than the forecast, it will support the markets, although not for long, since fixing the attention of investors at the Federal Reserve meeting on monetary policy will play a more prominent role.

Forecast of the day:

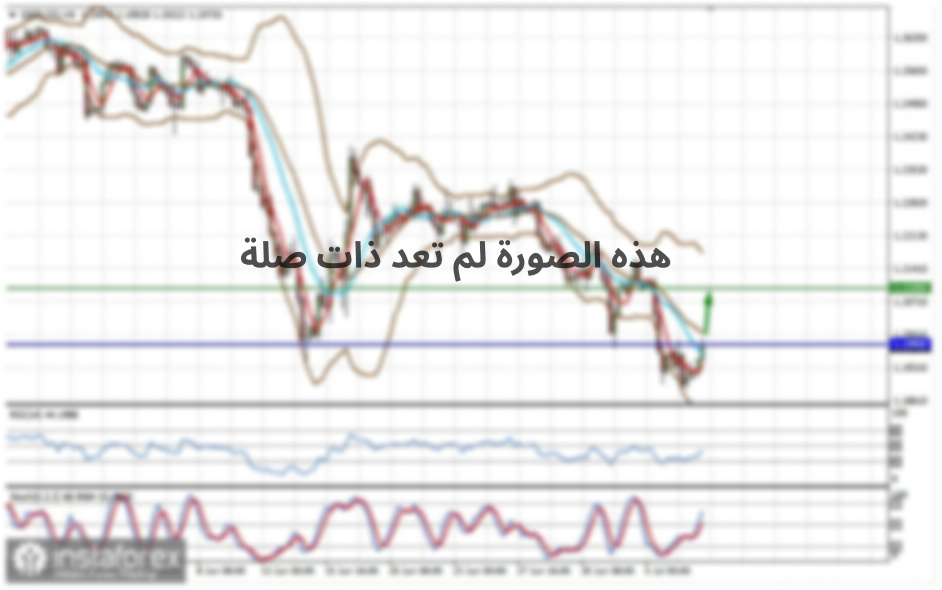

The EUR/USD pair remains in a difficult situation of uncertainty, forming a pattern of continuation of the "descending flag" trend. The lack of signals from the Fed about an earlier start to reduce the purchase of government bonds will lead to the growth of the pair.

But if today's American data is positive, it will also push up the demand for risk and weaken the US dollar. In this scenario, the pair may make an upward pullback to 1.2155 or even higher to 1.2195.